The abbreviation IFRS stands for International Financial Reporting Standards. These are accounting standards that have been developed by the I.A.S.B. (International Accounting Standards Board). Throughout the EU, these standards (if approved by the European Commission) are compulsory for all listed companies and are permitted in more than 100 countries. Unlisted companies have no obligation to follow the IFRS 16 standards, but if they wish, they too may apply these rules. Moreover, history teaches us that many rules that are first applied to listed companies will at a later stage also apply to unlisted companies.

IFRS accounting offers a number of advantages, which are discussed in more detail below.

Transparency is extremely important in today's business world. More and more companies are pursuing transparent policies and this also applies to accounting. If this is done according to IFRS standards, it makes it easier for capital providers and other parties to compare companies. A major advantage here is the possibility of comparing competitors in another country or continent, for example. Based on the information obtained from these comparisons, economic decisions can be made more easily. For example, investors can see at a glance how similar companies compare to each other and take a decision on that basis. In addition, it enables companies to compare themselves with each other, which can lead to new insights into market potential, among other things.

Take, for example, the comparison of balance sheet data and the profit and loss account. Here, incredibly large discrepancies can arise if everyone applies a different accounting method.

Car rental company A owns 100 cars and car rental company B owns 50 and rents 50. In this example, we assume that the turnover of both companies is the same, but if we look at the balance sheet before 1 January 2019 (effective date of the new IFRS 16 rules) they were completely different. After 1 January 2019 the balance sheet is the same.

International companies have to deal with different accounting rules per country. This can be unnecessarily complex and expensive. This can be avoided by using the IFRS 16 standards. Because IFRS accounting is so widely accepted, it allows accountants to use the same accounting in every country. This avoids the need to have a team in each country with specific knowledge about accounting in that country. This also reduces the cost of accounting.

The importance of being able to compare becomes clear once again. By keeping one set of accounts, international companies can easily compare their performance in different countries. This can be extremely valuable in making important decisions and transferring knowledge from country to country. It also allows companies to more easily identify opportunities and risks around the world and thus better allocate capital injections.

Finally, IFRS reduces the information gap created by applying and comparing accounts that work according to different regulations and standards. It is practically impossible to have knowledge of all the accounting methods used worldwide. By adopting IFRS 16 standards in accounting, the financial reporting is clear to everyone and no misunderstandings occur.

This enables investors, owners and other stakeholders to properly assess the management and call them to account when the data is incorrect or performance is inadequate. Here, too, transparency plays a role. Companies themselves are also accountable to regulators in each country. IFRS accounting makes it easier for regulators to identify discrepancies, errors and anomalous figures.

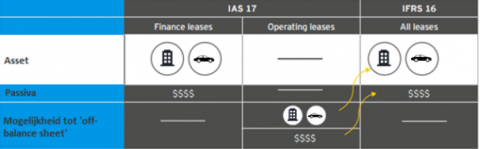

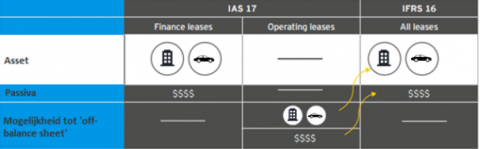

As a specialist for offices, our focus on IFRS is primarily on the changes for our tenants and landlords. Therefore, this is explained in more detail below. From 1 January 2019, all previously completely off-balance sheet rental obligations must be recognised on the balance sheet for all companies operating under IFRS 16. As accommodation is often a significant cost factor, this has a considerable impact on the balance sheet. There are further consequences for the income statement: Rental costs are no longer taken into account; interest and depreciation costs have to be disclosed. For companies that therefore comply with IFRS 16 regulations, all leases (including office space and vehicle leases) are recognised in the balance sheet. As a result, the solvency of companies decreases and cash flow increases. Only the portion of lease payments that represents interest on lease liabilities is reported as a financing activity. The main consequence of shifting leases on the balance sheet is an increase in long-term liabilities and the associated decrease in solvency. This makes it more difficult to realise a loan, financing or other capital raising. This is an annoying side effect that companies can avoid. More on this later.

Source: Masterthesis P.H.W. BRESSERS 2017 – EY (2016c)

Under this new regulation, two exemptions are granted:

So if a company leases an office for a short period of time, it does not have to be accounted for. As a result, the solvency ratio does not decrease, or at least decreases less. Finally, other things, such as car leases, have to be included under IFRS 16.

We see in our data that more and more companies are opting for a flexible lease. In many cases, it will make sense for companies to work with flexible leases instead of the long-term contracts that have been the norm. This way, the impact on the balance sheet is minimal. Companies with many properties/offices now opt for a combination of long-term leases/owned buildings and flexible offices. These latter offices form the flexible shell of the company and offer them the opportunity to quickly increase or decrease the number of square metres of office space they need. This flexible shell is also a way to reduce the impact of IFRS 16 on the balance sheet. This can be achieved through service level agreements for offices. Since the introduction of IFRS 16, there has been an increase in the number of service level agreements entered into for offices.

To ensure that the rent of your office space does not appear on the balance sheet, there are two options. Businesses can opt for a short-term contract or rent the offices under a service level agreement. This is a service level agreement that companies can sign with a service provider who rents out offices. As service level agreements are not subject to the latest IFRS 16 rules, they do not have to be recognised on the balance sheet.

A Service Level Agreement or SLA for offices is much more than just renting an office with a flexible contract. It is not only the renting of the office, but also everything that is associated with it as a service. Here you should also consider the following:

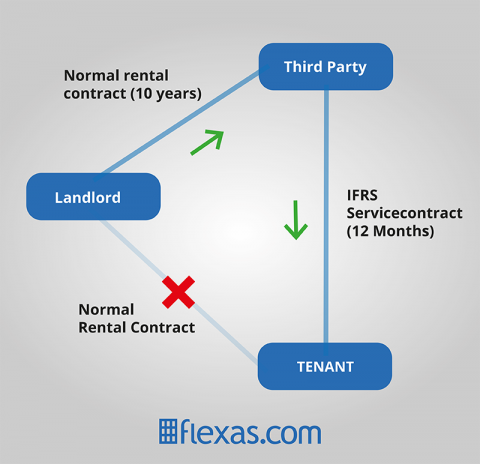

Such service level agreements for offices are mainly offered in business centres. The disadvantage of short-term contracts and office space as a service is that a higher rent is often charged for it, as the landlord has an increased risk. The tenant may also have to move unintentionally if the contract is not renewed by the landlord. In the picture below you can see how such a situation can look like. In this case, the "third party" is a business centre.

Flexas can put you in touch with various flexible office space providers, whereby you rent office space on the basis of a service level agreement, but perhaps your company does not want to or cannot move yet. Then there is also an alternative method to convert your existing office into a service level agreement that can be used according to IFRS 16 standards and therefore does not need to be accounted for. It is possible to convert the existing agreement, i.e. a third party takes over the long-term obligations with the principal and other providers and then leases it in a service level agreement with a flexible arrangement. This results in a higher monthly price, but has the advantage that it does not have to be shown on the balance sheet. However, it is important to know that it is not enough to just rent the office through a service level agreement. This is because it is the office as a service, and therefore the matters mentioned above, such as the renovation of the office, the rental of furniture and the use of facilities and other services, must also be included in the contract. It is a total package. Besides the options of business centres or transferring the current lease to a service level agreement for office space, there is another option. You can also rent a new office and purchase it through a Service Level Agreement. This is interesting in line with the new IFRS 16 regulations and offers a number of other advantages. Most notably in the area of capex, especially the lack of capex.

If you opt for an office with a Service Level Agreement, there are no investment costs for moving into the office; a third party does this as it is covered by the SLA. Investments for furniture, IT infrastructure, renovations and other start-up costs are therefore eliminated. Another advantage is that everything to do with renting your office is handled by one party. This means that you only receive one invoice per month and have one contact person for all matters. The shorter terms also offer more flexibility.

Would you like to rent an office? Check our offers!